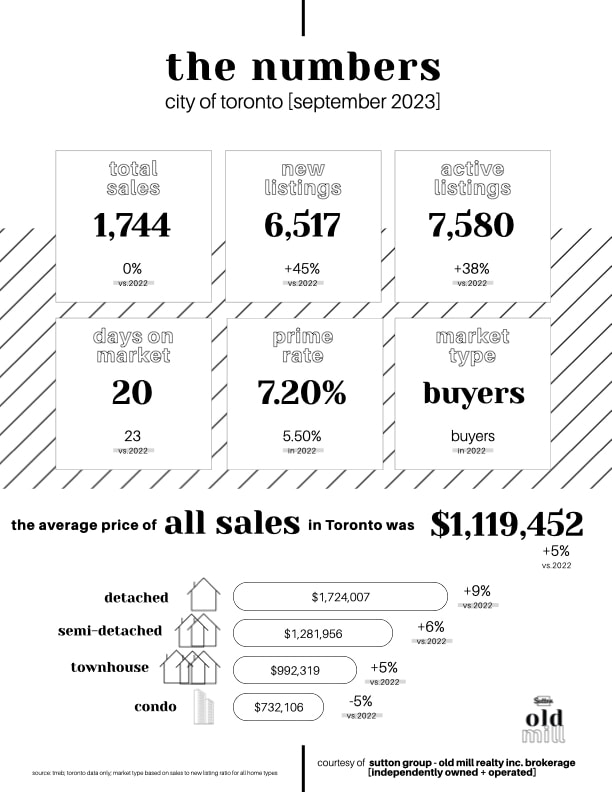

Despite persistent high borrowing costs, elevated inflation, a deceleration in economic growth, and uncertainty surrounding the decision-making process of the Bank of Canada, the Toronto housing market experienced a notable shift. In the face of a surge in property listings, the average price of a Toronto home surged by 5% in comparison to September 2022.

Notably, the dynamics varied within the housing market itself. Average selling prices for detached homes rose by an impressive 9%, semi-detached homes saw a 6% increase, while townhomes experienced a 5% uptick. In contrast, the condo market segment witnessed a 5% decline compared to the previous year.

With the influx of new listings, Toronto's Real Estate market has unmistakably transitioned into a Buyer's market. This shift suggests that prospective buyers may have already begun to, and are likely to continue, wield greater negotiating power, at least in the short term.

Looking further into the future, a consensus exists that borrowing costs will remain elevated until mid-2024. At this juncture, we anticipate a substantial surge in housing demand driven by the prospect of lower borrowing rates and unprecedented population growth.

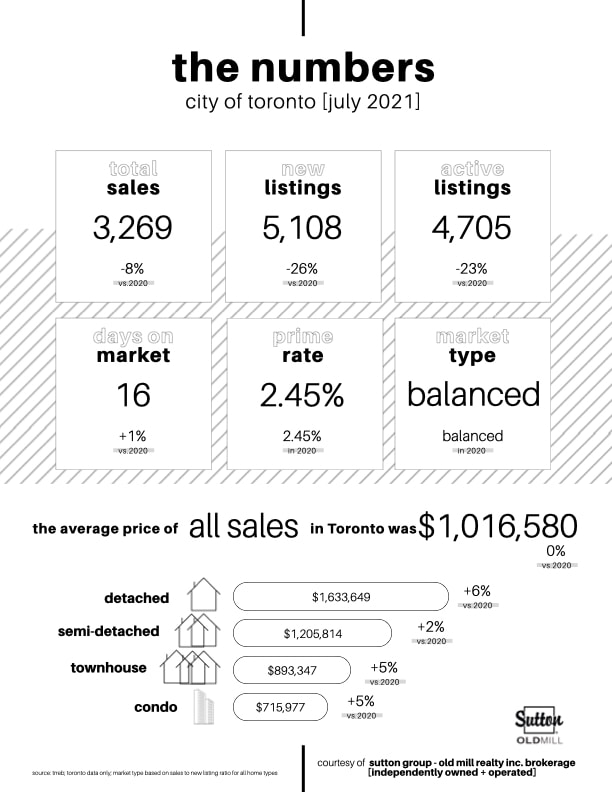

Looking to buy or sell a home in Toronto? Average prices in September were as follows:

➕Detached $1,724,007 [+9% vs. 2022]

➕Semi-detached $1,281,956 [+6% vs. 2022]

➕Townhouse $992,319 [+5% vs. 2022]

➕Condo $732,106 [-5% vs. 2022]

Data presented is for City of Toronto Only. Source: TRREB.

RSS Feed

RSS Feed