“Increased borrowing costs represent a short-term shock to the housing market. Over the medium- to long-term, the demand for ownership housing will pick up strongly. This is because a huge share of record immigration will be pointed at the GTA and the Greater Golden Horseshoe (GGH) in the coming years, and all of these people will require a place to live, with the majority looking to buy. The long-term problem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth,” said TRREB President Kevin Crigger.

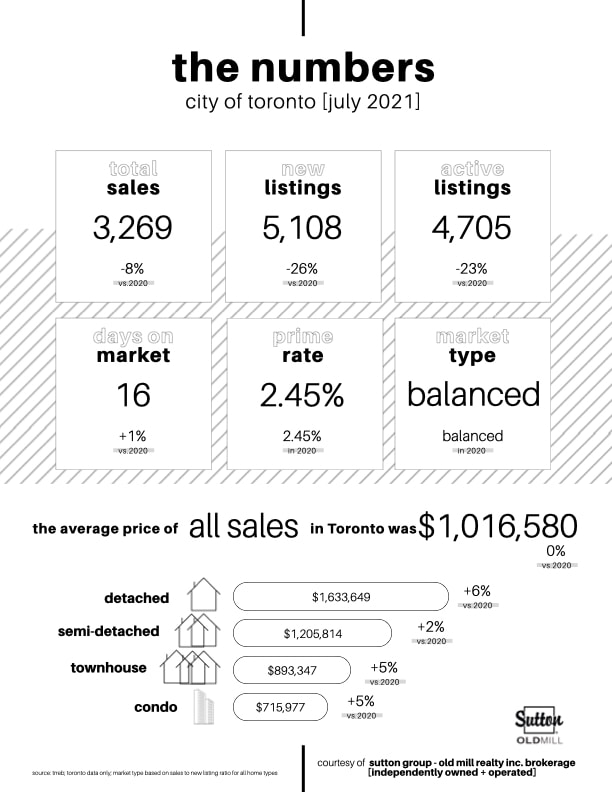

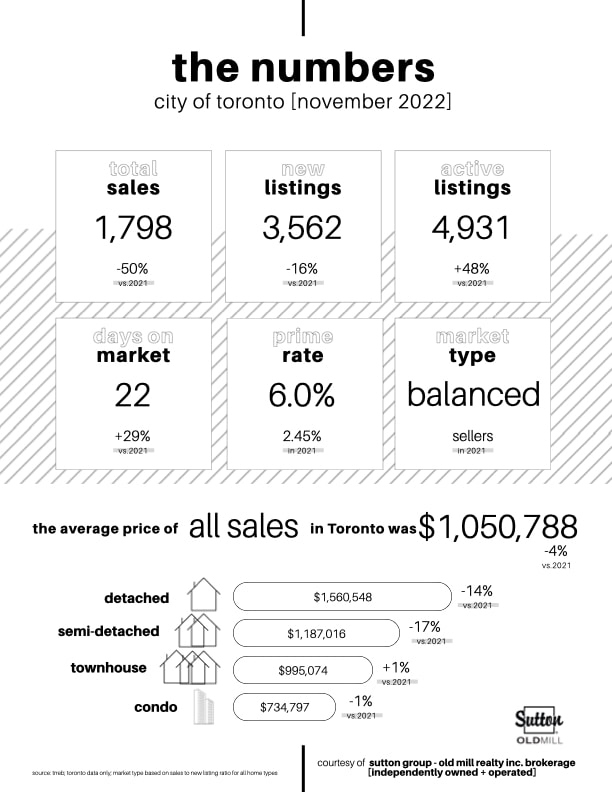

Looking to buy or sell a home in Toronto? Average prices in November were as follows:

➕Detached $1,560,548 [-14% vs. 2021]

➕Semi-detached $1,187,0162 [-17% vs. 2021]

➕Townhouse $995,074 [+1% vs. 2021]

➕Condo $734,797 [-1% vs. 2021]

RSS Feed

RSS Feed