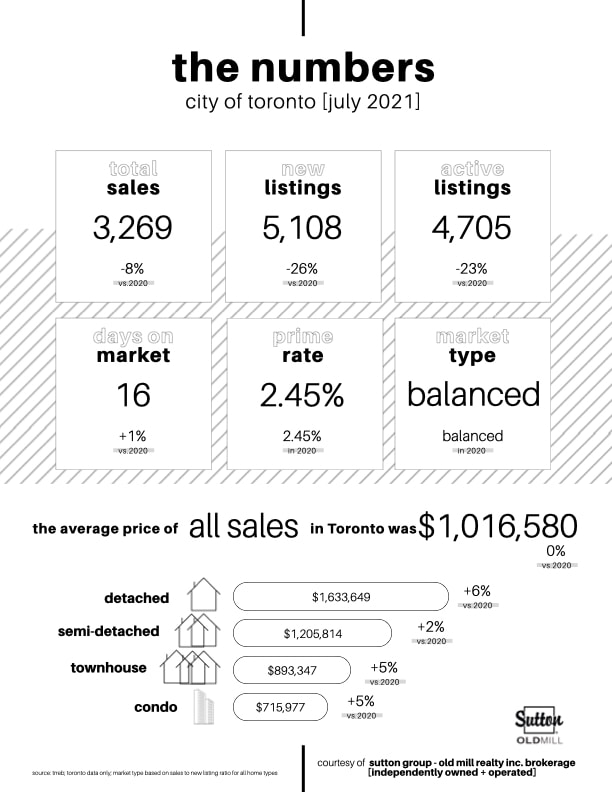

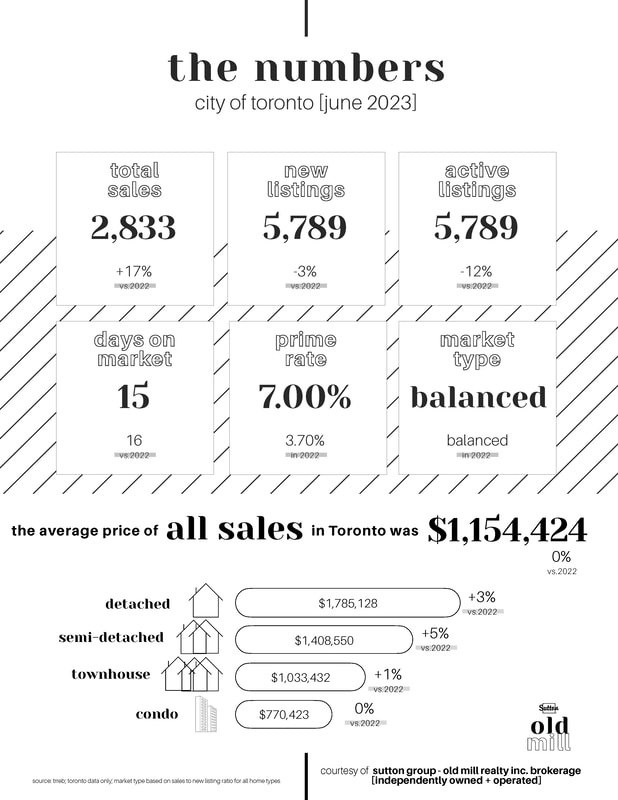

Despite higher borrowing costs, the demand for homeownership continues to grow, indicating a robust Toronto real estate market. Total sales were up +23% vs. June 2022, though trending slightly down [-4%] from last month.

What’s driving the demand? A resilient economy, a strong labor market, and significant population growth have all contributed to the continued strength in demand for Toronto housing.

Uncertainty surrounding inflation and future interest rate increases continues to impact new and active listing supply. This combination of higher sales and fewer new listings suggests tighter market conditions in June 2023 compared to the same period last year. Most notably, the increased competition contributed to average prices increases of +3% in the detached and +5% in the semi-detached market segments, when compared to last June.

The Bank of Canada's upcoming interest rate decision scheduled for July 12th and guidance on inflation and borrowing costs for the rest of 2023 will provide further insights into the market's anticipated trajectory for the remainder of the year.

Looking to buy or sell a home in Toronto? Average prices in June were as follows:

➕Detached $1,785,128 [+3% vs. 2022]

➕Semi-detached $1,408,550 [+5% vs. 2022]

➕Townhouse $1,033,432 [+1% vs. 2022]

➕Condo $770,423 [0% vs. 2022]

Data presented is for City of Toronto Only. Source: TRREB.

RSS Feed

RSS Feed