Home sales in July remained strong and surpassed last year's levels, indicating that many households have adapted to higher borrowing costs. However, the sales momentum experienced earlier in the spring has slowed down since the Bank of Canada resumed its rate tightening cycle in June.

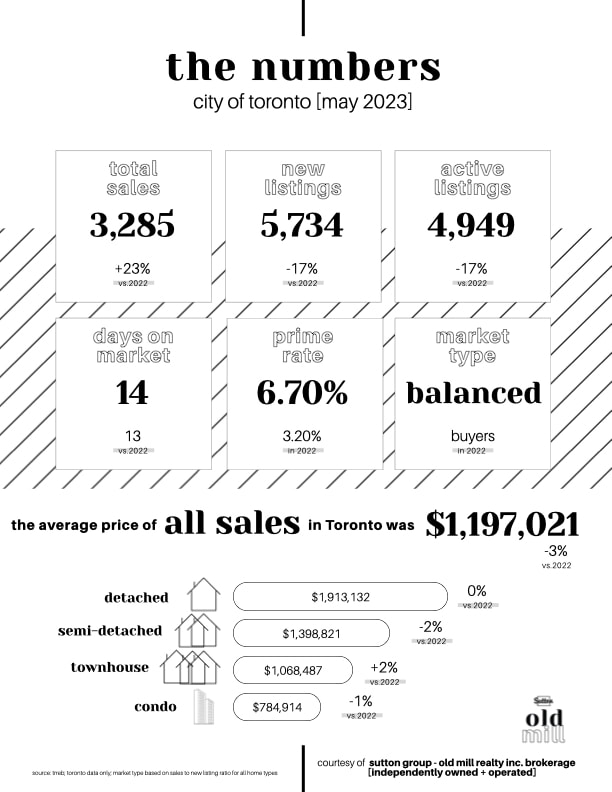

On the whole, the July market was more balance when compared to June - with sales trending lower and an increase in new listings. This combination has shifted Toronto real estate into a slight ‘Buyers’ market environment.

Despite the uptick in new listings, Toronto continues to face challenges due to a persistent lack of listings, compounded by higher borrowing costs, impacting home sales over the last two months.

Uncertainty surrounding the economy and borrowing costs is keeping some potential homebuyers on the sidelines in the short term. Additionally, there is a mismatch in public policy related to housing, with little progress in creating more affordable ownership and rental housing despite the record levels of immigration targeted by the federal government.

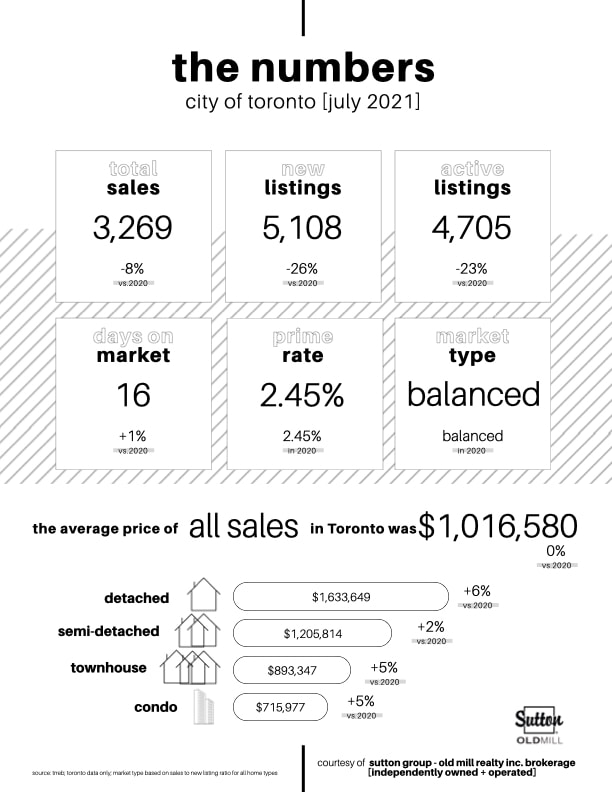

Looking to buy or sell a home in Toronto? Average prices in July were as follows:

➕Detached $1,641,045 [+8% vs. 2022]

➕Semi-detached $1,257,086 [-1% vs. 2022]

➕Townhouse $1,019,333 [+6% vs. 2022]

➕Condo $753,520 [+1% vs. 2022]

Data presented is for City of Toronto Only. Source: TRREB.

RSS Feed

RSS Feed