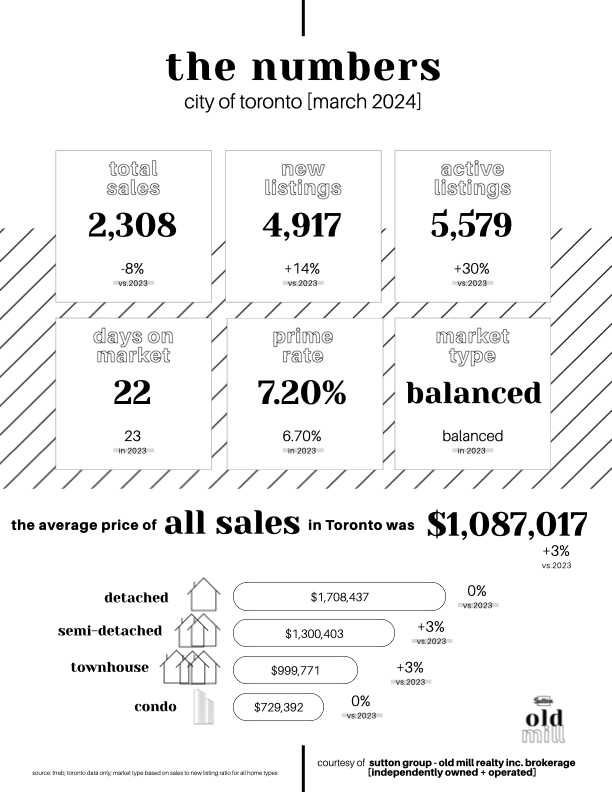

The recent Bank of Canada rate cut provided initial relief but hasn't yet spurred significant buyer activity. Industry consensus is that multiple rate cuts totalling approximately 100 basis points or more might be needed to boost home sales significantly.

The current well-supplied market offers buyers substantial choice and negotiating power. This condition is expected to continue as sales pick up with potentially lower borrowing costs, preventing a rapid increase in selling prices. However, as always, not all home sales are the same, with certain micro-neighbourhoods and home types still experiencing bidding wars.

Despite the continuing sales dip, largely a result of high interest rates, strong population growth is driving long-term demand for both ownership and rental housing.

In this dynamic landscape, it is vital to have a trustworthy and knowledgeable realtor by your side. Whether you're considering selling or buying a property, or if you have any real estate inquiries, feel free to reach out. We are here to guide you!

Looking to buy or sell a home in Toronto? Average prices in June were as follows:

➕Detached $1,758,649 [-1% vs. 2023]

➕Semi-detached $1,282,973 [-9% vs. 2023]

➕Townhouse $1,008,467 [-2% vs. 2023]

➕Condo $763,148 [-1% vs. 2023]

•••

Data presented is for City of Toronto Only. Source: TRREB.

RSS Feed

RSS Feed